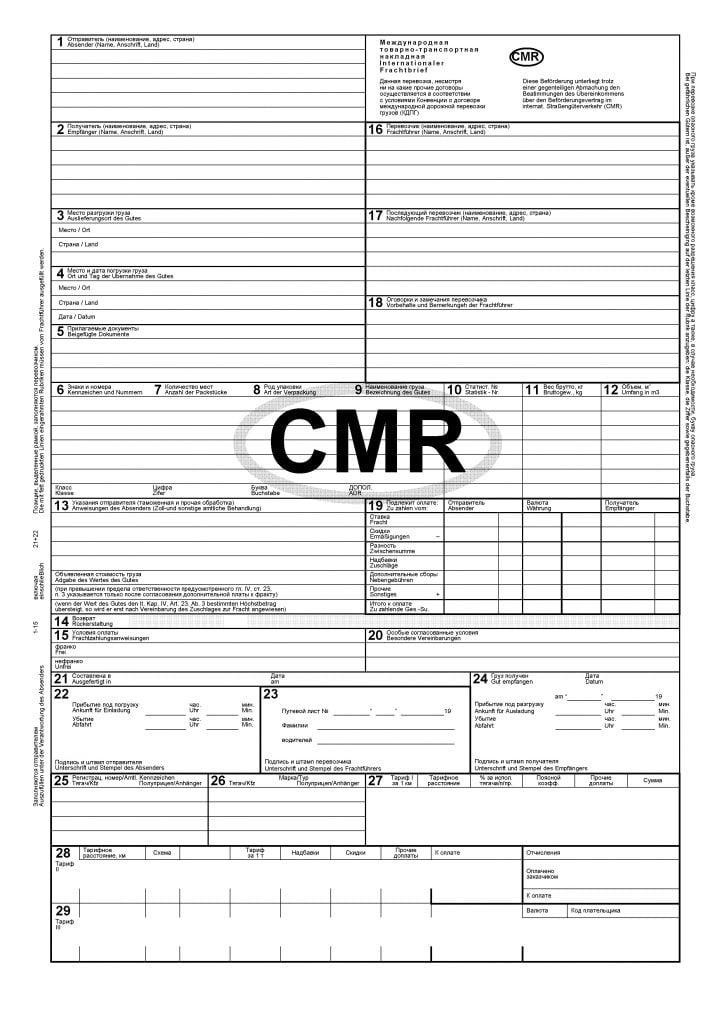

International consignment note CMR

CMR accompanies the contract for the international carriage of goods by road. To use the consignment note, it is sufficient that at least one of the countries between which the delivery is carried out has adopted the Convention on the Contract for the International Carriage of Goods by Road (CMR).

Filling procedure:

Column 1. Indicate the consignor company, its full address, country, city, zip code, street, and house number. If the goods are sent to Russia on behalf of the contract holder by a third company, the name of this company shall be indicated and a note shall be made: “on behalf of”. For example, “company B” (consignor) on behalf of “company A” (contract holder).

Column 2. The name of the consignee company, its full address, country, city, zip code, street, and house number shall be indicated.

Column 3. Address of the place of final unloading of the goods (warehouse of the consignee company).

Column 4. Address of the place of loading of goods and date of loading.

Column 5. The numbers of invoices (invoices, proforma invoices), TIR carnet number, if there are numbers of certificates (veterinary, phytosanitary, conformity, etc.).

Columns 6, 7, 8, 9, 10, 11, 12. The number of places, type of packaging, product names, HS codes, gross weight shall be indicated.

Column 13. An important column. The consignee’s customs authority (customs office, customs post and customs post code), temporary storage warehouse or customs warehouse, its address and license number (preferably indicating the expiration date of the license) shall be indicated.

Column 15. The terms of delivery according to Incoterms 2010 shall be indicated.

Column 21. Date of completing the CMR.

Columns 16, 17. The name of the carrier, its address shall be indicated. In this column the carrier puts his stamp.

Column 20. For the consignee’s notes. Date of the cargo receipt and printing date.

Columns 25, 26. License plate numbers of the tractor and trailer.

Comment to fill in:

Paragraph 1 indicates the details of the consignor (name, address, country). In addition to these data, the carrier shall specify the phone number and surname of the contact person of the consignor in the case any questions arise during transportation (at the customs or at the consignee). Paragraph 2 contains the details of the consignee (name, address, country). It is also required to have the consignee’s phone number to resolve issues at the customs upon entry into the country, to find the consignee’s office in case of poor command of the consignee’s national language. Paragraph 3 indicates the address of the unloading place. If the address of the unloading place is the same as the consignee’s address, the carrier should not have any special questions. However, as a rule, 50% of consignors specify different unloading place and consignee’s address. This is because the cargo is delivered directly to a branch, warehouse, or store. In this case, the carrier must have the phone number of the place of unloading, and if the consignee and the place of unloading are in different cities, then the carrier must call the cargo consignor to clarify the route and find out whether he should arrived at the consignee’s address first or go directly to the address of the unloading place. Paragraph 4 indicates the place and date of the cargo loading. Paragraph 5 contains a list of documents to be attached.

These include:

- Invoice;

- Shipping specification;

- Quality certificate if the goods are of industrial origin;

- Veterinary certificate if the goods are of animal origin;

- Quarantine certificate if the goods are of plant origin;

- Certificate of origin;

- Loading certificate;

- These documents are described in paragraphs 2-8.

In paragraph 6, signs and numbers indicating the class and subclass of hazardous goods transported, determined according to the ADR Convention, shall be specified. Features of the carriage of hazardous goods are described in paragraph 2.

Paragraph 7 contains the number of cargo places. As a rule, up to 90% of all goods transported by road are placed on pallets and it the carrier prefers indicating the number of pallets in paragraph 7. This number can be checked easily by determining the number of rows of pallets and multiplying them by two (there are two pallets per row in the cargo compartment).

Paragraph 8 indicates the type of cargo packaging (cardboard boxes, wooden boxes, metal or plastic barrels, canvas or polyethylene bags, etc.)

Paragraph 9 indicates the name of the cargo.

Paragraph 10 indicates the cargo code by classification.

Paragraph 11 indicates the gross weight in kilograms, that is, the weight of the cargo with packaging, and paragraph 12 – the volume of the cargo in cubic meters.

Paragraph 13 – consignor’s instructions (customs and other processing). This paragraph contains the details of the contract of sale of the goods (number and date of the contract) and, if a license or permit for the export of goods is required, the details of these documents shall be indicated. The box of paragraph 13 shows an envelope. What does it mean? The fact is that one copy of the contract of sale of the goods, as well as a license or permit for the export of goods from the country must be provided at the customs office where the customs clearance of the goods will take place.

The image of the envelope should remind the shipper and the carrier that these documents must be at the customs, and if they are not sent for some reason, the shipper will transfer them in an envelope with the carrier. At the bottom of paragraph 13 the declared value of the cargo shall be indicated. Article 23 (paragraph 3) of the CMR Convention establishes a limit of the carrier’s liability restricting the amount of compensation to $12 per kilogram of gross weight shortage (8.33×1.46 = $12.16). However, paragraph 6 of Article 23 provides that a more significant amount of compensation may be claimed from the carrier if the value of the goods has been declared in accordance with Articles 24 and 26.

In the case of declaration of the value of the cargo exceeding the limit specified in paragraph 3 of Article 23, the declared value replaces this limit. The Convention stipulates that upon declaration of the value of the cargo exceeding the liability limit, the carrier is entitled to additional freight to pay for the escort convoy.

In item 14, the state number of the semitrailer or container is indicated in case of their export from abroad after a temporary stay there. For example, if the semitrailer was temporarily left abroad for some reason (for repair in connection with an accident or after diagnostic control), then when it is exported to the country of registration, the license plate number shall be recorded in paragraph 14 of CMR.

*It is executed in three counterparts: for the consignor, carrier, and consignee.

*The document shall be signed by the consignor and the carrier.

EX-1 declaration

Declaration for goods manufactured in EU countries and exported outside the EU. EX-1 allows avoiding local VAT. The document shall be executed by representatives of the carrier or manufacturer (supplier) having a relevant license. The EX-1 declaration shall be presented when crossing the borders of the European Union.

T1 declaration

Declaration for accompanying the non-EU goods to the EU. It shall be executed by authorized representatives of the supplier or carrier at customs warehouses, at the EU border, if the goods are imported by land, and during transportation by air it can be executed directly on board of the aircraft.

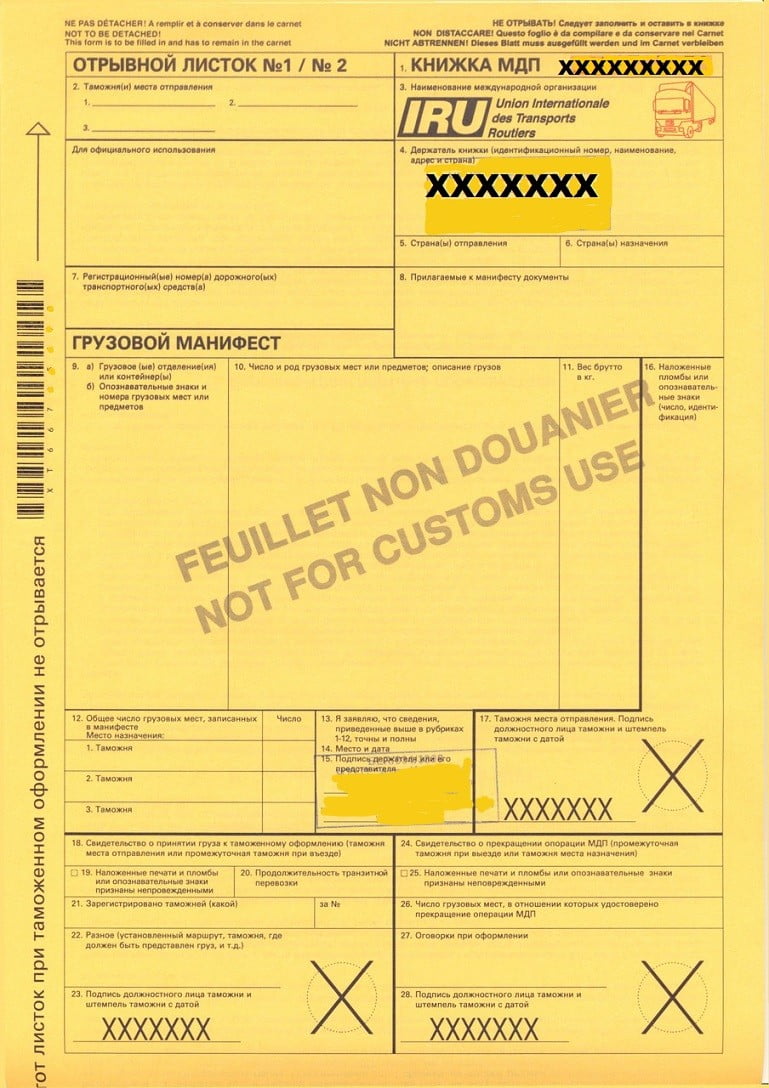

TIR (Transports International Routiers) system

The main purpose of the TIR system is to simplify the crossing of state borders for carriers, and to establish transparent rules for the customs authorities of the countries where the system is adopted. TIR works in more than 50 countries, and the customs authorities of these countries have authorized more than 4,000 carriers to work under this system.

System operation rules:

- cargoes are sealed during transportation and any access to them is excluded (due to the use of seals and special containers);

- the cargo is accompanied by a TIR Carnet (International Road Transport).

TIR Carnet is a document accompanying the cargo during transportation between the customs offices of the consignee and the consignor. The document shall be issued by authorized organizations (in Ukraine, it is the Association of Road Carriers) and looks like a book containing 4-14 sheets. The first sheet is fixed, and the inner ones shall be torn off when passing the next customs.

TIR CARNET is an international customs document giving the right to transport the goods across state borders in customs-sealed car bodies or containers under a simplified customs clearance procedure. The document covers road and rail transportation of goods (carried out in vans, trailers, semi-trailers and containers) between the states that have recognized the Customs Convention on the International Transport of Goods under Cover of the International Road Transport Carnets (TIR) 1959 and 1975 (see paragraph 4). All road vehicles must have appropriate permits issued by the competent authorities for their use.

Now increasingly more goods are transported using TIR. This speeds up delivery and reduces transportation costs.

Bill of lading is an invoice in sea transportation.

It is a document accompanying the cargo during sea transportation.

Functions and purpose of the bill of lading:

- it confirms receipt of the cargo by the carrier and description of the cargo condition;

- it serves as a consignment note and a shipping document;

- it confirms the contract for the carriage of goods.

The bill of lading shall be issued by the carrier to the consignor and certify the transfer of the goods for transportation. It is issued in three counterparts: for the consignor, carrier, and consignee. In this case, one of the copies is stamped “Original”, and the other two – “Copy”. The document stamped “Original” shall be sent to the consignee and allow receiving the cargo.

Data to be entered in the bill of lading:

- vehicle name;

- consignee’s details;

- consignor’s details;

- carrier’s details;

- data on the place of receipt and loading;

- cargo destination;

- time and place of the document issuance.

Airwaybill.

Document for air transportation.

An air waybill cannot be a document of title, but serves to confirm the existence of a contract of carriage and transfer of cargo to the carrier. On the other hand, an air waybill can serve as a customs declaration.

The document is prepared by the consignor (or his agent) under the invoice in three counterparts:

1. For the carrier. It shall be signed by the consignor and kept by the carrier;

2. For the consignee. It shall be signed by the consignor and the carrier and kept by the consignee;

3. For the consignor. It shall be delivered to the consignor of the goods and confirm the delivery and acceptance of the goods by the consignee.

Data entered into the airwaybill:

- departure and arrival points;

- list of documents attached to the consignment note;

- cargo value;

- the cost of freight;

- date of execution.

*The consignor shall be fully responsible for the accuracy of the data in the airwaybill

Types of invoices:

MAWB: It shall be issued by the airline and contain information about the agents or shipper in the country of departure and the country of receipt.

HAWB: It shall be issued by the agent and contain full information about the consignor and consignee based on the invoice attached to the cargo.

*The number of the waybill is always unique, and this number can be used to track the cargo.

EN

EN